Informasi Keuangan

PT LOTTE CHEMICAL TITAN TbkKinerja Keuangan PT LOTTE CHEMICAL TITAN Tbk dan entitas anak dirangkum dibawah ini.

Halaman utama

Hubungan Investor

Informasi Keuangan

Ikhtisar Laporan Laba Rugi dan Penghasilan Komprehensif Lain Konsolidasian

[Dalam Ribuan Dollar US]| Deskripsi | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

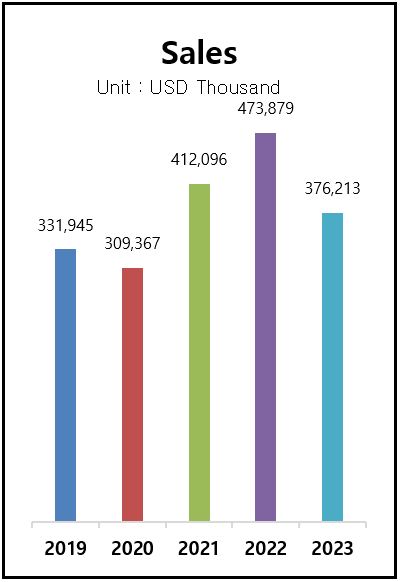

| Pendapatan | 309,367 | 412,096 | 473,879 | 376,213 | 367,977 |

| Laba Kotor | 1,943 | 23,595 | 14,490 | 6,433 | (4,044) |

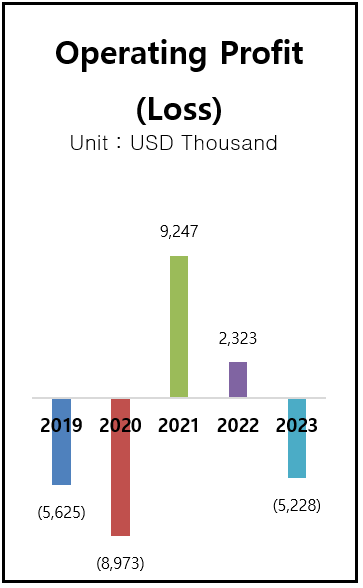

| Laba (Rugi) Usaha | (8,973) | 9,247 | 2,323 | (5,528) | (14,676) |

| Laba (Rugi) Sebelum Pajak | (7,825) | 12,232 | 3,147 | (1,140) | (11,174) |

| Laba (Rugi) Bersih Konsolidasi | (4,945) | 9,564 | 2,896 | (400) | (8,294) |

| Laba (Rugi) yang dapat diatribusikan kepada pemilik entitas induk dan kepentingan non pengendali | (4,945) | 9,564 | 2,896 | (400) | (8,294) |

| Laba (Rugi) Komprehensif | (4,172) | 9,470 | 2,857 | (500) | (8,396) |

| Laba (Rugi) komprehensif yang dapat diatribusikan kepada pemilik entitas induk dan kepentingan non pengendali | (4,172) | 9,470 | 2,857 | (500) | (8,396) |

| Laba (Rugi) per Saham (nilai penuh) | (0.0009) | 0.0017 | 0.0005 | (0,0001) | (0.0015) |

Ikhtisar Laporan Posisi Keuangan Konsolidasian

[Dalam Ribuan Dollar US]| Deskripsi | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Jumlah Aset | 149,377 | 183,022 | 192,224 | 182,670 | 161,914 |

| Jumlah Liabilitas | 54,215 | 78,390 | 84,735 | 75,681 | 63,321 |

| Jumlah Ekuitas | 95,162 | 104,632 | 107,489 | 106,989 | 98,593 |

| Rasio Lancar | 158% | 165% | 151% | 136% | 128% |

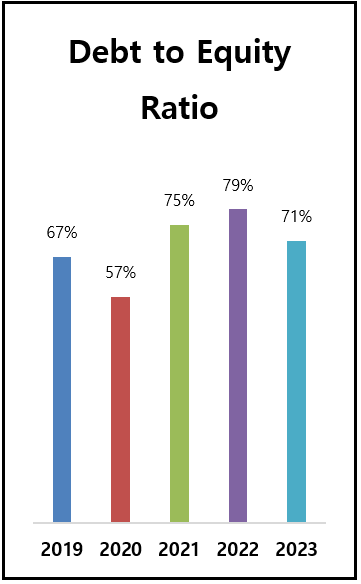

| Rasio Liabilitas terhadap Ekuitas | 60% | 75% | 79% | 71% | 64% |

| Rasio Liabilitas terhadap Aset | 36% | 43% | 44% | 41% | 39% |

| Rasio laba (rugi) terhadap pendapatan | (1.60%) | 2.32% | 0.61% | (0,11%) | (2.25%) |

| Rasio laba (rugi) terhadap aset | (3.31%) | 5.23% | 1,51% | (0,22%) | (5.12%) |

| Rasio laba (rugi) terhadap ekuitas | (5.20%) | 9.14% | 2,69% | (0,37) | (8.41%) |